2026 - New Year Investment Update

Happy New Year from all of us at Windsor Wealth.

At the start of every year, there is no shortage of market forecasts, with commentators and experts confidently telling us where markets are headed and what investors should expect next. These forecasts are mostly noise and rarely leave us better informed. As Warren Buffett famously said, “Forecasts tell you more about the forecaster than what is actually about to happen.”

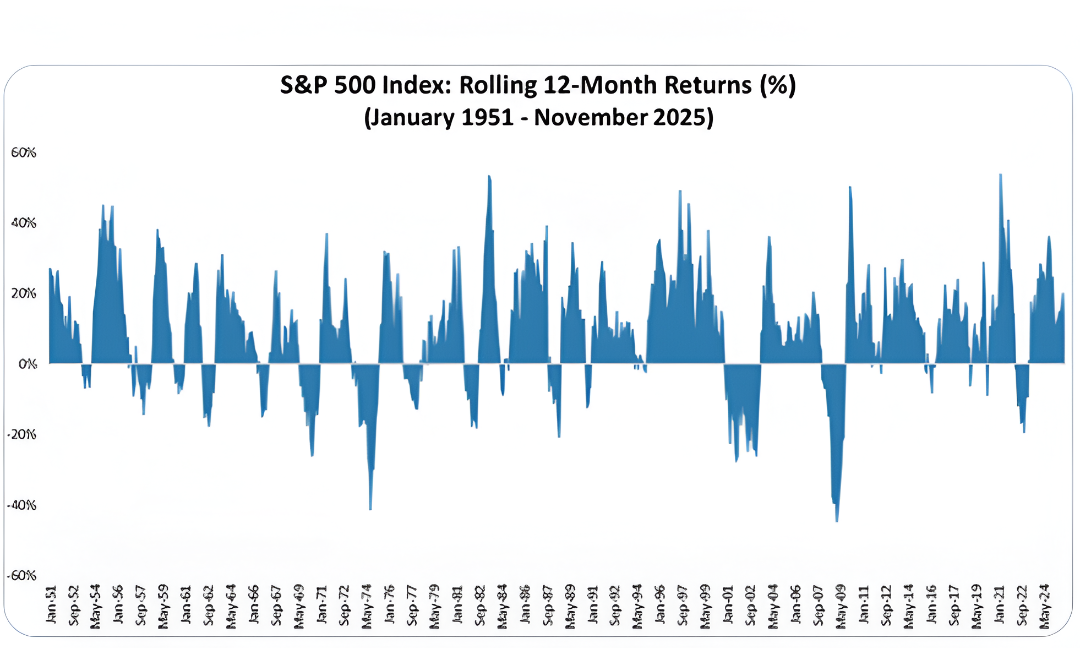

As the chart below shows, investment returns on an annual basis are random and unpredictable. This is why it is so important to stick with a long-term plan and take care not to fiddle with portfolios based on short-term views.

What we do know is this.

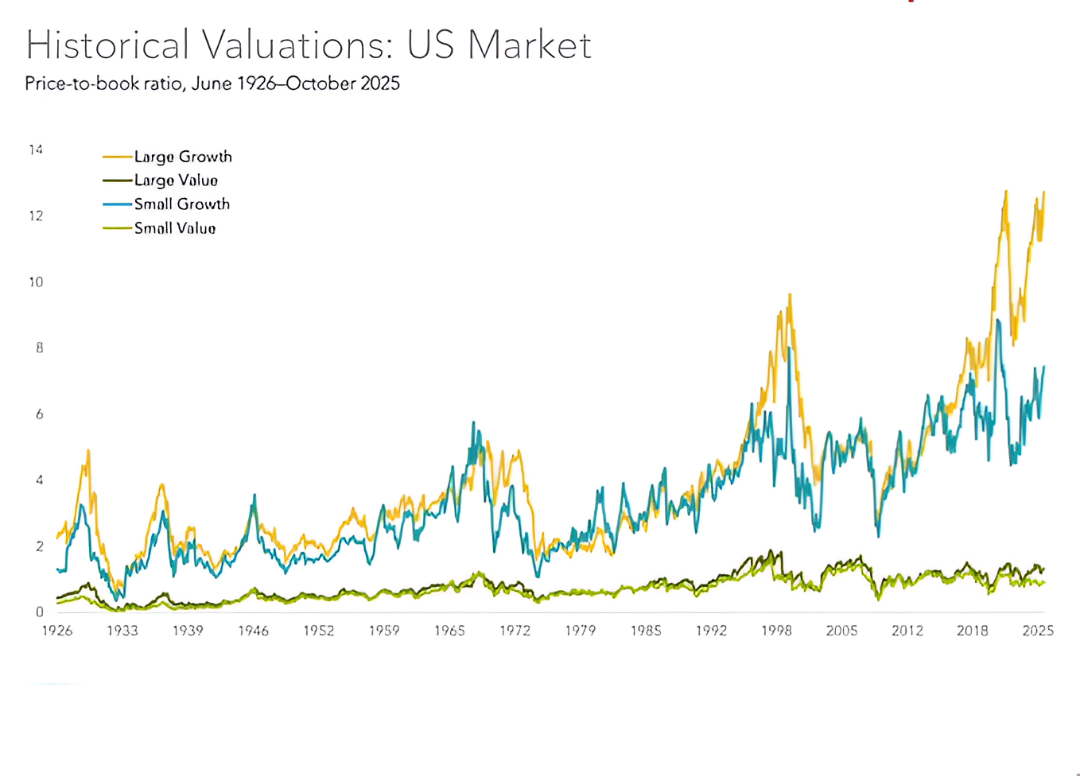

Some parts of the market, such as large technology companies, are expensively priced, while other areas, including smaller companies and value-oriented businesses, are fairly priced or even cheap.

Without trying to predict the year ahead with a crystal ball, current conditions suggest it is sensible to allocate more toward companies with more reasonable valuations. This is not about certainty. It is simply a high-percentage approach when parts of the market feel overheated. It allows us to remain invested and participate in growth, without taking unnecessary risk.

The positioning we consider sensible in the current market is evident in strategies such as those used by Dimensional. These approaches are designed to reduce exposure to the most expensive and frothy parts of the market, while maintaining diversification. By placing greater emphasis on valuation and profitability, they tend to be more resilient during challenging periods, while still participating in market growth over time.

Similarly, Berkshire Hathaway is well positioned due to its long-standing focus on valuation discipline, combined with substantial cash reserves. This gives it the flexibility to buy assets at attractive prices if markets experience a particularly difficult period.

Importantly, we do not want to eliminate growth or technology altogether. Smart investing is about having the probabilities on our side, not about making decisions with 100% certainty. It is entirely possible that large technology companies have a stellar year in 2026. We want some exposure to that upside, while still building portfolios that are, overall, less expensive and more resilient than the broader market.

If we do not try to shoot for the stars, we are very unlikely to shoot ourselves in the foot, and we are certainly not investing for calendar year results!

As always, if you would like to review your investments or talk through your plan for the year ahead, please get in touch.